50 cents

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Quisque sed felis. Aliquam sit amet felis. Mauris semper, velit semper laoreet dictum, quam diam dictum urna, nec placerat elit nisl in quam. Etiam augue pede, molestie eget, rhoncus at, convallis ut, eros. Aliquam pharetra. Nulla in tellus eget odio sagittis blandit. Maecenas at nisl. Nullam lorem mi, eleifend a, fringilla vel, semper at, ligula. Mauris eu wisi. Ut ante dui, aliquet nec, congue non, accumsan sit amet, lectus. Mauris et mauris. Duis sed massa id mauris pretium venenatis. Suspendisse cursus velit vel ligula. Mauris elit. Donec neque. Phasellus nec sapien quis pede facilisis suscipit. Aenean quis risus sit amet eros volutpat ullamcorper. Ut a mi. Etiam nulla. Mauris interdum. Read More →

Remedy Games

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Quisque sed felis. Aliquam sit amet felis. Mauris semper, velit semper laoreet dictum, quam diam dictum urna, nec placerat elit nisl in quam. Etiam augue pede, molestie eget, rhoncus at, convallis ut, eros. Aliquam pharetra. Nulla in tellus eget odio sagittis blandit. Maecenas at nisl. Nullam lorem mi, eleifend a, fringilla vel, semper at, ligula. Mauris eu wisi. Ut ante dui, aliquet nec, congue non, accumsan sit amet, lectus. Mauris et mauris. Duis sed massa id mauris pretium venenatis. Suspendisse cursus velit vel ligula. Mauris elit. Donec neque. Phasellus nec sapien quis pede facilisis suscipit. Aenean quis risus sit amet eros volutpat ullamcorper. Ut a mi. Etiam nulla. Mauris interdum. Read More →

In Asian trading today, the U.S. Dollar slipped broadly lower as markets ponder the likely outcome of today’s Federal Open Market Committee Meeting. As reported at 3:39 p.m. (JST) in Tokyo, the greenback traded against the Australian Dollar at $1.0853, the lowest trade in 29 years. While against the safe haven Swiss Franc, the U.S. Dollar dropped to a record low 0.8669 Swiss Francs. The U.S. Dollar Index, which measures the greenback’s strength vis-à-vis a weighted basket of major currencies, touched on a 3-year low of 73.493 .DXY earlier and traders expect that the record low of 70.698 .DXY is likely soon to be struck.

The majority of market players are speculating that the Federal Reserve’s current loose monetary policy will continue for the near term as the Fed works to revive the U.S. economy. What is of paramount concern to markets and analysts alike is how the Fed will exit their current quantitative easing scheme, which is scheduled to conclude at the end of this quarter. Fiscal problems in the U.S. are also playing a role in the greenback’s weakening, with a significant budget deficit and a debt ceiling that is likely to be hit as soon as next month.

Meanwhile, the common currency Euro continues to benefit from decisive and aggressive monetary policy in the Eurozone, even as troubled member nations there continue to struggle with debt. Earlier, the Euro was trading higher against the U.S. Dollar at $1.4715, breaking through the $1.47 barrier established in December 2009.

http://www.dailyforex.com/forex-news/2011/04/US-Dollar-Falls-Ahead-of-FOMC-Meeting/7774

Analysts say market jitteriness is being soothed by upbeat earnings reports in the U.S. and Europe, and investor sentiment is leaning toward higher risk currencies as the market well absorbed earlier concerns over Greek debt and a U.S. debt downgrade.

One analyst noted that investors are favoring currencies which offer higher yields at the Dollar and Yen’s expense, and a recent rise in the Asian equity market highlights investors’ sentiment toward risk-taking. The U.S. Dollar rose against the Japanese Yen, gaining 0.4% to trade at 82.91 Yen. The Euro also gained against the Japanese currency, climbing nearly 0.8% to trade at 119.27 Yen, well off a 2-week low of 116.49 Yen struck on the EBS trading platform earlier in the week.

http://www.dailyforex.com/forex-news/2011/04/Euro-Rebounds-in-Asia-on-Interest-Rate-Hike-Speculation/7726

Speaking to reporters, Trichet commented that he didn’t see second-round inflation as a significant threat, comments which prompted some traders to dump their long positions in the common currency. Overall, however, most market players are certain that the greenback will be under pressure for the long term, given that the Federal Reserve is unlikely to alter its current ultra loose monetary policy.

http://www.dailyforex.com/forex-news/2011/04/Euro-Slips-in-Asian-Trading-as-Trichet's-Patience-with-US-Policy-Wanes/7762

The U.S. Dollar edged slightly lower against the Japanese Yen in Tokyo trading as investors pared away their carry trade positions, but most analysts expect that move will be short-lived with hedge fund operators and Japan-based life insurers positioning themselves ahead of what is likely to be another Yen slide. As reported at 3:13 p.m. (JST) in Tokyo, the U.S. Dollar slipped against the Yen to 82.42 Yen, off a 3-week trough of 82.19 Yen. Speculation is that Japanese hedge funds and life insurers will buy back the greenback for Treasury and debt purchases as and when it falls nearer to 82 Yen.

The Euro, yesterday, took a hard hit as investors’ fears resurfaced that Greek debt will need restructuring within the next few months, well ahead of the launch of the permanent stability mechanism. Also, the United States has been cautioned with a negative outlook by yet another ratings agency, this time Standard & Poors, that their current AAA credit rating is in jeopardy of being downgraded unless the deficit problem is addressed soon. One analyst said that while the negative outlook might have come as a jolt, it was really no surprise to anyone and that markets should absorb fairly well.

http://www.dailyforex.com/forex-news/2011/04/U.S.-Dollar-Lower-Against-Yen-as-Investors-Reposition-for-Yen-Slide/7720

The increase in higher risk assets is being attributed to robust corporate earnings from the United States, an indication that the global economy is moving forward in spite of the Federal Reserve’s stance that the current ultra loose policy is appropriate at this point in time. The outlook for the U.S. dollar remains dim in the long-term however, with investors worrying about the impact that a debt downgrade could have on the Fed’s ability to buy bonds at the currently low prices. The U.S. Dollar has been under pressure from the majority of currencies; against the Euro, it lost 0.7% to trade at $1.4612 after striking a low of $1.4618 on the EBS trading platform.

http://www.dailyforex.com/forex-news/2011/04/Investors-Shun-Safe-Havens-Sending-Dollar-Index-to-3-Year-Low/7736

The Australian dollar climbed to $1.0766, up from $1.0714 in New York yesterday, after reaching $1.0772, the strongest since it was freely floated in 1983. The Australian Dollar was at 88.33 yen from 88.45 yen, while the New Zealand’s dollar rose to 80.34 U.S. cents, up 0.7% the highest level since March 2008.

Analysts noted that the Australian Dollar has risen 3.8% in the past 6 months and has outperformed other dollar currencies, including the New Zealand dollar and the Canadian dollar. The country’s bonds, however, fell for the second consecutive day.

http://www.dailyforex.com/forex-news/2011/04/AUD-Reaches-Record-High/7734

Despite the continued chance of debt restructuring in Greece which threatens to wreak havoc on the regional economy, the Euro rallied to a 16-month high against the US dollar as speculation increased that the ECB will continue to raise interest rates this year.

Although last week’s trading was shortened due to Good Friday, this week’s global economy may fluctuate greatly as several upcoming events may impact the major currency pairs. Among the events to keep an eye on are:

Continued close of the markets in Australia, New Zealand and Europe for an extended Easter holiday today, Monday, April 25.

On Tuesday, April 26, Australia is scheduled to publish information about its economic indicators, which should offer an insight into the direction of AUD based Forex currency pairs.

On Wednesday, April 27, US Fed Chairman Ben Bernanke will hold a press conference which follows the banks’ rank-setting meeting.

On Thursday, April 28, the Bank of Japan will once again address the disasters that have shaken the country and will likely suggest additional measures of protection.

On April 29, Germany is expected to publish information about consumer price index and unemployment rates both within its borders and in the wider Eurozone.

http://www.dailyforex.com/forex-news/2011/04/Global-Markets-Closed-New-Reports-Expected/7753

The newest concern among market players is Finland, which last week’s regional elections sent the True Finns political party, considered anti-Euro by many political watchers, to the Finnish Parliament. According to the that government’s constitution, the Finnish parliament has the constitutional right to vote on all European Union requests for bailout assistance, suggesting it could hold up E.U. aid plans for Portugal specifically, as well as create instability, in general.

The only thing propping up the Euro at this point is that prospect that the European Central Bank will move to raise interest rates again following the recent data which showed Eurozone inflation rising higher to 2.7% as compared to the same period a year earlier; economists had expected an increase to 2.6% last month.

http://www.dailyforex.com/forex-news/2011/04/Eurozone-Debt-Worries-Resurface-to-Hold-Euro-Lower-vs-Dollar-Yen/7704

Market players are even more concerned that recovery of the U.S. economy could falter if the agreement between the President and the Legislature is insufficient to significantly reduce the deficit, either through tax hikes or spending cuts. Either or both could compel the U.S. Federal Reserve Bank to maintain their interest rates at the current historic low, even at a time when central banks throughout the world are raising interest rates to fight inflation.

Most analysts agree that the Dollar’s decline comes from the loss of investors’ confidence in U.S.-denominated assets, especially given the recent threat of a credit downgrade by Standard & Poors. Markets now seem to be measuring the impact of a U.S. debt downgrade, although they had well accepted and absorbed the announcement originally.

http://www.dailyforex.com/forex-news/2011/04/U.S.-Dollar-Index-Approaches-All-Time-Record-Low/7747

As reported at 2:46 p.m. (JST) in Tokyo, the Euro is trading against the greenback at $1.4472, edging back 0.1% from late Thursday trading in New York but still within striking distance of the $1.4521 peak struck earlier in the week. Most market players don’t believe the Euro will face difficulty rising above $1.45, especially given the Eurozone’s debt problems and with Irelands’ credit rating being downgraded earlier today.

Recent rhetoric from several Federal Reserve officials has increased investor speculation that the central bank’s ultra loose monetary policy is likely to remain as such for an extended length of time. Collectively, the position of the Fed is that inflation – and the subsequent hikes in the prices of commodities – remains transitory and manageable by the current policy. The European Central Bank, conversely, continues to closely watch inflationary pressures and acknowledges that it is ready to move again with additional interest rate hikes if the situation warrants.

http://www.dailyforex.com/forex-news/2011/04/Ireland-Downgrade-Only-Marginally-Affects-Euro/7698

As reported at 3:20 p.m. (JST) in Tokyo, the Yen fell against the Euro to 121.91 Yen on the EBS trading platform, an 11-month low. Against the Aussie, the Yen slipped 0.7%, trading at 88.27 Yen, while against the greenback the Yen slipped 0.5% to 83.50 Yen.

Beginning today through tomorrow, officials from the Bank of Japan will be meeting to discuss policy in the wake of the crisis. Most analysts expect that they will signal their willingness for further easing measures, if necessary.

http://www.dailyforex.com/forex-news/2011/04/Yen-Continues-to-Slip-Broadly-Lower-Under-G7-Manipulation/7620

The U.S. Dollar rose against the Japanese Yen in Tokyo trading today as pension fund operators in Japan, as well as Japanese importers, bought the greenback heavily. As reported at 3:04 p.m. (JST) in Tokyo, the U.S. Dollar was trading against the Yen at 84.04 Yen, up from the 83.59 Yen in New York trading late Tuesday. Earlier in the session, the Dollar had slipped close to the 200-month moving average of 83.50 Yen. The Euro was also higher against the Yen, trading at 121.67 Yen on the EBS trading platform, up from the 120.98 Yen trade late in New York yesterday. The Japanese Yen had been sent soaring in yesterday’s trade as safe haven investors pushed the currency higher following the announcement by the Japan Nuclear and Industrial Safety Agency that they had raised the threat rating of the Fukushima nuclear plant accident to a level equivalent to that of Chernobyl. Today’s absence of bad news, generally, is apparently driving risk appetite higher, sending the Yen lower again. Most analysts agree that the USD/JPY will be testing the upside for the near term. Later today, focus should shift to the U.S. where retail sales data is expected to be released; further on in the global day, the U.S. Federal Reserve’s Beige Book update will also be released, providing a behind-the-scenes indication of the U.S. economy’s direction. The U.S. Dollar Index, a gauge of the greenback’s value versus other major currencies, was recently at 79.906 .DXY, up from 74.863 .DXY.

http://www.dailyforex.com/forex-news/2011/04/Absence-of-Bad-News-Sends-Yen-Lower/7677

Elsewhere, the Euro held steady just below a 5-month peak versus the U.S. Dollar, as investors reassess their positions ahead of the ECB policy setting meeting to be held later this week. Most analysts expect that the European Central Bank will hike the current rate by 25 basis points to 1.25% in an attempt to stave off inflationary pressures in the Eurozone, driven primarily by higher commodity prices. Analysts are expecting that before year’s en, the ECB will have raised their benchmark rate to 1.75%. So far this year, the Euro has gained better than 6% against the greenback. Earlier, the Euro was trading against the U.S. Dollar at $1.4192. Further gains in the Euro are likely to be limited, given that rate hikes are already factored in.

http://www.dailyforex.com/forex-news/2011/04/Aussie-Dollar-Slips-Following-RBA-Rate-Decision/7613

In light of the recent disasters in Japan, the International Monetary Fund reduced its forecast for Japanese growth from 1.6 to 1.4. This behavior is typical for the Japanese currency during times of disaster. The IMF’s forecast for 2012 was raised from 1.8 percent to 2.1 percent.

http://www.dailyforex.com/forex-news/2011/04/Dollar-and-Yen-Strengthen-After-New-Earthquakes-Hit/7667

While the interest rate hike is not yet a done deal, many economists are suggesting that given the fiscal state of several of the Eurozone nations, i.e. Portugal, Spain, Greece, etc., an interest rate hike will be more harmful than good.

As reported at 2:57 p.m. (JST) in Tokyo, the Euro slipped against the U.S. Dollar, trading at $1.4297 following yesterday’s surge to $1.4350. Near term support is pegged around $1.4285 to $1.4250; some currency strategists say that if the Euro can’t rise well above $1.4282, it could retreat to near $1.4160. Against the Yen, the Euro was trading at121.77 Yen following yesterday’s 11-month peak. Most analysts agree that the long-term outlook for the Yen is on a downtrend.

http://www.dailyforex.com/forex-news/2011/04/As-ECB-Meeting-Looms-Euro-Falls/7631

The common currency Euro, on the other hand, is approaching highs against the U.S. Dollar, as investors speculate that the ECB will continue to tighten monetary policy following the recently implemented interest rate hike. As reported at 2:58 p.m. (JST) in Tokyo, the Euro gained nearly 0.5% to trade at $1.4508, close to the 15-month peak of $1.4521. The U.S. Dollar also fell lower against the Japanese Yen, trading at one point at 83.20 Yen on the EBS trading platform, and well off the 6½ month peak of 85.55 Yen struck last week. One FX strategist in London pointed out that the U.S. Dollar has no new factors on which to rise, since it appears obvious that the Federal Reserve is not going to change its current stance anytime soon, given lingering high unemployment.

http://www.dailyforex.com/forex-news/2011/04/U.S.-Dollar-Index-Strikes-16-Month-Trough-in-Asia/7684

Against the U.S. Dollar, the Yen was trading at $1.4269 on the EBS trading platform, a 5-month peak. Most traders expect the Euro to continue to gain broadly until the meeting takes place as speculation becomes reality.

Market Fluctuations

In spite of repatriation inflows, the Japanese Yen remains under downward pressure as the coordinated efforts of the G7 continue, and from growing speculation that the Japanese central bank may downgrade the country’s economic assessment later in the week. The U.S. Dollar gained slightly against the Yen, trading up 0.1% to 84.11 Yen; on Friday, the greenback struck a 6-month peak of 84.735 Yen on the EBS trading platform.Most analysts see the Dollar’s rise to be limited, and possibly reversing, as the Federal Reserve’s controversial quantitative easing program draws to a close. Some analysts note that the Fed’s stance has become more hawkish in recent days, but one key Fed board member refuted those claims noting that a change to current policy is very far away.

http://www.dailyforex.com/forex-news/2011/04/Euro-Striking-New-Multi-Month-Highs-as-ECB-Meeting-Looms/7602

By: Barbara Zigah The Japanese Yen slipped lower against the common currency and the Australian Dollar in Asian trading today, and analysts expect further weakening as risk appetite increases, generally. As reported at 2:52 p.m. (JST) in Tokyo at one point in the session on the EBS trading platform the Euro traded against the Yen at 123.33 Yen, a 16% gain from the mid-March trough of 106.50 Yen, before trimming gains to 122.62 Yen. The Australian Dollar also struck a 2 ½ year high against the Yen, when it struck 90.04 Yen earlier in the session; later, some of the gains were pared when it traded at 89.64 Yen still higher by 0.1%. According to analysts, the Japanese central bank is likely to lag behind other countries’ central banks in order to give their nation a chance to recover from the tragic earthquake and tsunami which struck last month. The Japanese economy had been in a long period of stagflation, and most analysts agree that this event will likely shift the economy’s direction. The Japanese Yen had been a consistently strong currency prior to the earthquake, and repatriated flows endanger its resumption. The G7 has been collectively and successfully working to suppress the Yen’s rise.

http://www.dailyforex.com/forex-news/2011/04/Japanese-Yen-Continues-Downtrend-with-G7-Intervention/7649

The Euro is being buoyed by yesterday’s announcement of an ECB rate hike of 25 basis points. Against the U.S. Dollar the Euro struck a 15-month peak, trading at one point to a high of $1.4405. Investors had been keen to hear the press conference held afterward by Jean-Claude Trichet, the ECB President, but the bank’s direction remains somewhat unclear with the Bank in wait-and-see mode. Some economists are expecting that the ECB will hold the rate in check through July, when rising inflation will likely prompt another hike.

http://www.dailyforex.com/forex-news/2011/04/Yen-Slips-Further-while-Euro-Buoyed-by-Rate-Hike/7644

As reported at 2:46 p.m. (JST) in Tokyo, the Euro is trading against the greenback at $1.4472, edging back 0.1% from late Thursday trading in New York but still within striking distance of the $1.4521 peak struck earlier in the week. Most market players don’t believe the Euro will face difficulty rising above $1.45, especially given the Eurozone’s debt problems and with Irelands’ credit rating being downgraded earlier today.

Recent rhetoric from several Federal Reserve officials has increased investor speculation that the central bank’s ultra loose monetary policy is likely to remain as such for an extended length of time. Collectively, the position of the Fed is that inflation – and the subsequent hikes in the prices of commodities – remains transitory and manageable by the current policy. The European Central Bank, conversely, continues to closely watch inflationary pressures and acknowledges that it is ready to move again with additional interest rate hikes if the situation warrants.

http://www.dailyforex.com/forex-news/2011/04/Ireland-Downgrade-Only-Marginally-Affects-Euro/7698

This is particularly visible against the currencies where the CHF reached all time extremes, such as the US Dollar, the British Pound and the Euro. On the daily chart of the EUR-CHF, we can see the rally from 1.2409 to the current 1.3220. This happens to be a very important resistance level tested twice before.

This is particularly visible against the currencies where the CHF reached all time extremes, such as the US Dollar, the British Pound and the Euro. On the daily chart of the EUR-CHF, we can see the rally from 1.2409 to the current 1.3220. This happens to be a very important resistance level tested twice before.A breakout above this level would signal a continuation in this rally, suggesting the next objective at 1.3675 or so. Perhaps more importantly, though, it would complete the double bottom reversal pattern in the EUR-CHF, likely reversing the long-term bear market in this pair.

For that, we must see a daily close above the resistance, which has not happened yet. In addition, one should be mindful about the ECB rate decision on Thursday. Markets are clearly expecting a hike in rates, something that the central bank hinted at before. If there is no action, the Euro could suffer for a while. In the long run, though, the EUR-CHF is poised to move higher.

http://www.dailyforex.com/forex-technical-analysis/2011/04/EUR-CHF-Poised-to-Go-Higher/7624

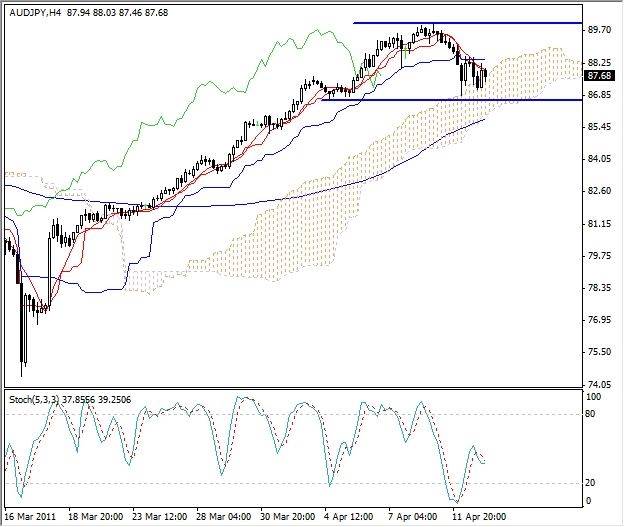

Last week the AUD-JPY reached a high for this price swing at 90.02. Since then it had drifted lower, including a relatively sharp sell off on Tuesday, which pushed it down to 86.85. That level is an intermediate term support, established by a minor low couple of weeks ago.

Last week the AUD-JPY reached a high for this price swing at 90.02. Since then it had drifted lower, including a relatively sharp sell off on Tuesday, which pushed it down to 86.85. That level is an intermediate term support, established by a minor low couple of weeks ago. What's Happening Now?

As of right now, the intermediate term chart appears to be forming a trading range, very typical after a strong trend. It is hard to say, what the outcome will be – continuation of the rally or a correction of larger magnitude. That will be decided when the AUD-JPY moves through either the support or the resistance.The support appears to be firm, with not only the previous low serving in this role, but also the Ichimoku cloud and the 100 SMA located nearby. On the upside, the recent high provides resistance at 90.02. Since this is psychologically important level (round number), the resistance might be solid, too, possibly locking the AUD-JPY into this trading range for some time.

http://www.dailyforex.com/forex-technical-analysis/2011/04/AUD-JPY-Forming-A-Trading-Range/7676

In case of the GBP-NZD the current move is even larger, about 1600 pips, as measured from the high of 2.2520 to the low of 2.0915 reached last Friday. However, the daily progress is getting smaller and smaller, indicating that the momentum maybe running out.

In case of the GBP-NZD the current move is even larger, about 1600 pips, as measured from the high of 2.2520 to the low of 2.0915 reached last Friday. However, the daily progress is getting smaller and smaller, indicating that the momentum maybe running out.When looking at the daily chart of the GBP-NZD, we can classify this sell off as a corrective move within the larger, primary bullish price swing, from 1.9858 to 2.2520. In this context, we could expect the price to reverse and resume the uptrend soon.

What's Happening Now

Currently, the GBP-NZD is at a possible important support. That is the proximity of the 62% Fibonacci retracement level, where reversals often happen. Here the price is also at the 100 SMA, another technical support/resistance tool.In addition, the Stochastic Indicator is at extremely low reading, meaning short-term oversold conditions. Altogether, the daily chart of the GBP-NZD suggests that the 2.0900-2.1000 area is vulnerable to a reversal and the price could turn around here, resuming the uptrend.

http://www.dailyforex.com/forex-technical-analysis/2011/04/GBP-NZD-Testing-Important-Support/7611

This rally in the rally has not been effected all of its crosses. The EUR-CAD, for example has hardly moved at all over the past two weeks, and settled into a consolidation. The price tested the trendline, even dipped under it, but so far remained above, preserving the uptrend.

This rally in the rally has not been effected all of its crosses. The EUR-CAD, for example has hardly moved at all over the past two weeks, and settled into a consolidation. The price tested the trendline, even dipped under it, but so far remained above, preserving the uptrend. What Can We Learn From This?

It is clear that the EUR-CAD “waits” for a catalyst to push it either way. The price is in a holding pattern, with technical indicators confirming it. We can see that the Bollinger bands have contracted sharply, which typically happens before a larger move starts. That is what we should expect here soon, but in which direction?Breaking either the nearest support or resistance will likely decide the next market move. However, since the trendline is intact, continuation of the uptrend is a little more likely. The ADX should also turn up for additional confirmation. It is possible for the EUR-CAD to start moving again as early as Tuesday, after the Bank of Canada policy meeting.

http://www.dailyforex.com/forex-technical-analysis/2011/04/EUR-CAD-Consolidation-Could-End-Soon/7664

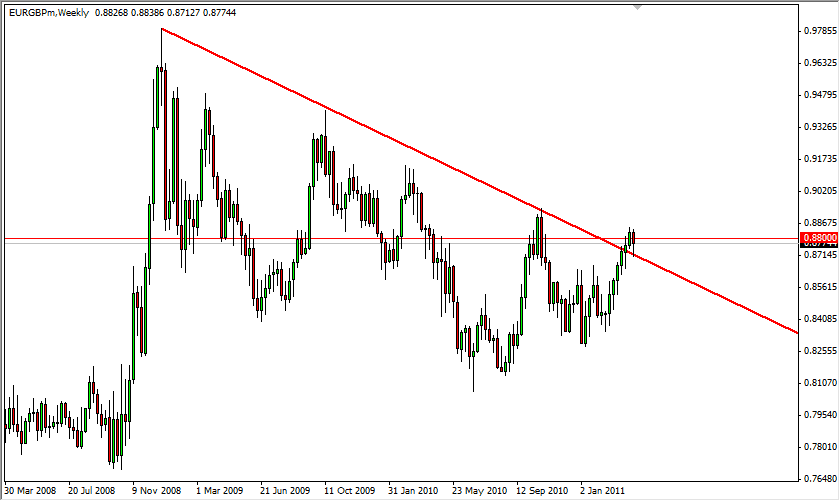

Two weeks ago, the pair had tested the 0.88 level, a key level in this pair. Although it failed, we found ourselves pushing above it the following week. This past week has had us fall again, only to bounce northward as buyers stepped in. It should be noted that there was a massive downtrend line that had gotten violated two weeks ago. This trend line was not only broken, but at the lows of this week was retested and confirmed as support.

Following Trend Lines

When looking for a breakout, the more conservative traders will wait for a pullback and a retest of the trend line to find if it will reverse courses. As the trend line was such heavy resistance since November of 2008, it should be expected to serve as fairly strong support as well. As we push higher, the 0.88 level is proving to be a pivotal level yet again as it attracts so many buyers and sellers.By looking at this trend line however, it appears that the bulls are starting to take control again, and we may have seen a capitulation of sorts by the sellers. The trend appears to be reasserting itself as this pair will certainly target the 0.90 level and then on to the 0.92 and 0.97 areas as well. Of course, if the pair breaks lower than the trend line, or the 0.87 level - we would have a false breakout of sorts.

The fundamentals also line up for this move, as the European Central Bank is getting ready to raise rates this week for the first time in a couple of years. This should be very bullish for the Euro in general, and should play out to be quite a healthy move in this pair. Of course, the real focus this week will be on the statement that the central bankers make as to whether or not more rate cuts are likely. However, it appears that the fundamentals and the charts are starting to line up which may be a sign of things moving back to some sense of normalcy. This pair shouldn't be any different.

http://www.dailyforex.com/forex-technical-analysis/2011/04/EUR-GBP-Breaking-Recent-Downtrend/7632

Currently the price is about to test that record low. On Wednesday, the USD-CHF dropped to 0.8928 in quiet trading. While it was a slow day not just for this pair, but for most other currencies as well, a slowdown so near an important level like here signals uncertainty and advises caution.

Currently the price is about to test that record low. On Wednesday, the USD-CHF dropped to 0.8928 in quiet trading. While it was a slow day not just for this pair, but for most other currencies as well, a slowdown so near an important level like here signals uncertainty and advises caution. Chances are that the price will encounter a strong support in this area. We can see the last daily candlestick forming a doji, which, following a bearish day could be a harbinger of a corrective move. Doji patterns require confirmation, so a bullish candlestick is needed now.

Other technicals also support a correction from this level. Both the RSI and the MACD indicators could have the makings of divergences. Since the price has not made new low yet, these are still only potential divergences. However, all these factors increase chances for the USD-CHF to find a support at the all time low, if only temporarily.

http://www.dailyforex.com/forex-technical-analysis/2011/04/USD-CHF-Is-Testing-the-Record-Low/7683

During the last few days, the USD-JPY made additional gains, rallying to 84.72 on Friday. In the process, it breached an important resistance of 84.50, established by a high (B). That happens to be latest minor high within the downtrend, the highest point between the last two lows (A and C). Moving through this resistance makes a strong argument for a major trend reversal.

During the last few days, the USD-JPY made additional gains, rallying to 84.72 on Friday. In the process, it breached an important resistance of 84.50, established by a high (B). That happens to be latest minor high within the downtrend, the highest point between the last two lows (A and C). Moving through this resistance makes a strong argument for a major trend reversal. For that, however, we need to see a close above 84.50, something what the daily chart of the USD-JPY failed to do so far. The recent price run up has been so fast, that it could be overbought on short-term bases, as suggested by the Stochastic Indicator. A slight pull back or a consolidation is very likely now.

Looking a little farther ahead, 1-2 weeks or so, the newly forming uptrend should continue. The ADX is rising, but at a reading of 34 is not overbought or overextended – that comes at above 50. If the price moves back above 84.50, we could see a real bull market, taking to USD-JPY to 88.00 and perhaps even 90.00 within weeks.

http://www.dailyforex.com/forex-technical-analysis/2011/04/What-Is-Next-For-USD-JPY/7600

In case of the NZD-CHF, this could be corrective move within the large bearish price swing that preceded it. This pair sold off from a high of 0.7475 in February, to the recent low of 0.6380. Since then, of course, we had the current rally to 0.7172.

In case of the NZD-CHF, this could be corrective move within the large bearish price swing that preceded it. This pair sold off from a high of 0.7475 in February, to the recent low of 0.6380. Since then, of course, we had the current rally to 0.7172. Is a Rounded Top Forming?

The price action as seen on the intermediate term chart has stalled, spending a week within a range of about 100 pips. It is also assuming a shape of a rounded top, which a reversal formation. Rounded tops, once completed, tend to have staying power, meaning that they are as reliable as chart patterns get.To complete this rounded top, the NZD-CHF must move under 0.7045, which is a pivot point here, established by a minor low on April 4. The MACD and the RSI are already drifting south, confirming a possibility of a reversal. If this rounded top is completed, the NZD-CHF could easily drop 150-200 pips.

http://www.dailyforex.com/forex-technical-analysis/2011/04/Possible-Rounded-Top-in-NZD-CHF/7647

One of them was the GBP-JPY, the ever-popular “beast”. For about a week following the intervention, it settled into a sideways pattern, before the uptrend developed. Over the last two weeks the GBP-JPY rallied about 1000 pips with very little pause. During that time, we can find only two brief slow-down periods on the intermediate term chart, both of them in the form of a flag.

One of them was the GBP-JPY, the ever-popular “beast”. For about a week following the intervention, it settled into a sideways pattern, before the uptrend developed. Over the last two weeks the GBP-JPY rallied about 1000 pips with very little pause. During that time, we can find only two brief slow-down periods on the intermediate term chart, both of them in the form of a flag. What's Going on Now?

Currently the price is forming yet another one of these patterns. Flags are continuation formations, so we could expect another move up, perhaps as high as 142.00. This particular flag is not as tight as the previous examples, but this is typical in an advanced trend. Of course, this also means that flags at this stage also have somewhat higher failure rate.If the price breaks out to the upside, we would like to see a confirmation using other tools. During this uptrend, the ADX has been working just fine in this role by showing an uptick on a move. We would like to see the same behavior here, with the ADX turning north. This would improve chances for another good size swing in the GBP-JPY.

http://www.dailyforex.com/forex-technical-analysis/2011/04/GBP-JPY-Forming-Another-Flag/7642

This particular price swing may be ending. Numerous technical factors suggest a possibility of a reversal/correction soon. When looking at the daily chart of the NZD-USD, we can see how the recent run up fits within the larger picture. Thursday’s high of 0.7645 (C), happens to be at 62% Fibonacci retracement level of the major swing down from 0.7974 (A) to 0.7108 (B). Markets often reverse at the 62% level, and that could be the case here as well.

This particular price swing may be ending. Numerous technical factors suggest a possibility of a reversal/correction soon. When looking at the daily chart of the NZD-USD, we can see how the recent run up fits within the larger picture. Thursday’s high of 0.7645 (C), happens to be at 62% Fibonacci retracement level of the major swing down from 0.7974 (A) to 0.7108 (B). Markets often reverse at the 62% level, and that could be the case here as well.Fast pace of the latest advance also pushed it just outside the upper Bollinger bands, meaning that the price is out of norm. We can see what happened in the past when this situation occurred – a correction of some magnitude in almost every instance.

In addition, the daily candlesticks are bearish. The last complete one is a doji, or a small body variation of one, indicating indecision and possible reversal. If the current candlestick is bearish at closing time, a probability for a pull back/correction in the NZD-USD would become even stronger

http://www.dailyforex.com/forex-technical-analysis/2011/04/NZD-USD-Rally-May-Have-Run-Its-Course/7595

For the North American session, eyes were all on budget negotiations and data releases were only second tier so relative yields played a large part in cementing direction. For the record, U.S. wholesale inventories came in as expected, up 1.0% and unchanged from a revised previous figure. Wall St finished the week on a soft note resulting in an almost flat performance on the week. Canada’s employment data was mixed with a drop in unemployment mostly as a result of a fall in the participation rate while headline employment change looked on the soft side but masked a strong increase in full-time jobs.

It is a slow start to the week on the data front in Asia and the session was spent consolidating the gains made against the U.S. dollar on Friday. News that the U.S. government narrowly avoided a shutdown had little noticeable effect. In weekend events, we have seen an escalation in tensions in the Middle East with protestors killed in Yemen, Syria and Egypt but the only impact was felt in oil markets.

China released trade data for March during the weekend and printed a small trade surplus, +$0.14 bln, which was a big surprise considering consensus was for a deficit of $3.35 bln. While March data shows a strong rebound from February’s $7.3 bln deficit, it still meant that in Q1 China recorded its first quarterly deficit in 7 years (-$1.02 bln). Has it helped global imbalances?

The European session is also relatively mundane on the data front with CPI data from Denmark and Norway and industrial production from France and Italy featured. There are no data releases for North America but we have speeches from the Federal Reserve’s Dudley and Yellen and the European Central Bank’s Weber.

http://www.dailyforex.com/forex-fundamental-analysis/2011/04/US-Government-Narrowly-Avoids-a-Shutdown/7656

The bank has already injected the equivalent of 10% of the nation’s GDP ($439 billion) into the financial markets since the crisis struck. The move was sufficient to restore confidence to the markets in Japan and around the world and, after an intervention from other G7 members, ward off a bull-run on the Yen. In recent days, the Yen has weakened against other major currencies and is currently trading at 121.4747 against the Euro, its weakest level since May last year.

Things to Expect Looking Forward

Given the magnitude of the problems facing Japan (and the Japanese recovery was considered fragile even before the disaster struck), the Bank cannot solve the problems on its own. Analysts suggest that the government may take steps to ensure that reconstruction efforts move ahead as swiftly as possible which would help macroeconomic conditions. The wisdom of the Bank underwriting a government bond issue to fund reconstruction activities has been questioned since it could undermine confidence in its monetary policy. It is anticipated that the Bank will announce measures to assist businesses affected by the crisis with fast-tracked, cheap credit. The Bank has also made it clear that its quantitative easing activities will continue as a a mechanism to ensure greater liquidity in Japanese financial markets.Revised survey data shows that business sentiment has fallen from a value of plus six before the crisis, to minus two in its aftermath.

http://www.dailyforex.com/forex-fundamental-analysis/2011/04/Bank-Of-Japan-Considers-Its-Options/7627

Demand in Europe and the USA, critical Chinese export markets, continues to be sluggish as the regions slowly emerge from the financial crisis. China is hoping to stimulate domestic demand and be less reliant on its exports, but it is also having to take steps to rein-in inflation and prevent a property bubble from bursting.

The consequences of the recent Japanese natural disaster are also likely to have an impact on China since Japan is China’s largest importing partner. It remains difficult to determine the knock-on effect of the Japanese earthquake in her trading partner’s economies and the picture will only emerge after the full extent of catastrophe on Japan’s own economy becomes clearer.

A Look at China's Recent Past

China was quick to emerge from the global recession and has produced spectacular growth in comparison with the world’s other leading economies. The rise of China as a major economic power has been export-led. It remains to be seen whether the Q1 figures will be just a blip, or if there has been a more fundamental readjustment of her trading balance over the shorter term.China remains under criticism for keeping its currency artificially low. Whilst some movement has been seen over the past twelve months, the appreciation of some 4% against the US Dollar needs to be put in context. The Dollar is coming off historic lows against the Yen and has depreciated by 7.8% against the Euro since this time last year. If the effects of the sovereign debt crisis in Europe are taken into account, it becomes clear that the Yuan is being manipulated.

http://www.dailyforex.com/forex-fundamental-analysis/2011/04/China-Posts-Rare-Trade-Deficit/7675

According to Eurostat, the level of unemployment within the 17 countries which use the Euro has fallen to below 10% for the first time in more than a year. The figure for February came in just below the 10% mark at 9.9%. A closer analysis of the data shows that the unemployment picture within the Eurozone is very heterogeneous. In the Netherlands, just 4.3% of the workforce is unemployed whereas in Spain 20.5% of the population of working age are looking for work. In Germany, the powerhouse economy of the Eurozone region, unemployment stands at 6.3%. Across the Eurozone as a whole, some 15.8 million citizens are currently without work.

Data released in the USA last week shows that unemployment there has fallen for the second consecutive month. The figure is the best seen in America for two years and reveals that 8.8% of the workforce is currently unemployed (March data). The figure has eased from 8.9% in February and has improved by more than one percent over the last four month period. The private sector was responsible for the creation of most of the new jobs, a situation which is likely to continue as America tries to reduce its deficit.

http://www.dailyforex.com/forex-fundamental-analysis/2011/04/Unemployment-Rates-Fall-In-Europe-and-USA/7616

The Icelandic authorities were unable to guarantee the investments of British and Dutch savers and so the British and Dutch governments stepped in to underwrite the debt, totalling some €4 billion, when the Icesave bank went bust. Icesave was the foreign arm of the Lansbanki bank and had attracted 400000 savers in the Netherlands and Britain. Whilst the British and Dutch governments stepped in to the breech, it was always understood that the Icelandic authorities would pick up the pieces.

Possible Options

A deal to repay the funds was put together by parliament, but was vetoed by the Icelandic president, triggering a referendum that the government lost. A second deal was put together, but again, the Icelandic people have rejected it (this weekend) on the grounds that they should not be asked to pay for a private bank’s debts. The margin was 61% to 49% and it is highly unlikely that it will be put to the people a third time.This leaves the British and Dutch governments with little option other than taking Iceland to court to recover the money. Iceland is keen to join the EU and both Britain and the Netherlands have the power to veto accession. Iceland will need to resolve the matter before it is able to fully access financial markets to fund its borrowing needs – the will of the people notwithstanding.

http://www.dailyforex.com/forex-fundamental-analysis/2011/04/Icelandic-Referendum-Invites-Dutch-and-British-Court-Action/7663

The Portuguese needed to raise money to service its existing debts, coming to the market to raise €1 billion. However, although the bond issue was successful, Portugal had to pay higher interest following the decision last week by ratings agency Moody’s to downgrade the nation’s credit rating from A3 to Baa1. The lower the rating of a bond (or nation) the greater the perceived risk of a default on the debt in question; consequently, investors demand greater interest rate to compensate them for the higher risk associated with the bond issue. Before the downgrade, last month, Portugal had to pay interest of 3% and 4% to borrow money for six and 12 months, but these rates had increased to 5.1% and 5.9% in yesterday’s bond auction respectively.

European Commission President, Jose Manuel Barosso, promised that the Portuguese request would be dealt with as swiftly as possible. There has been little reaction to the Portuguese request on the currency markets although the Euro is marginally lower against the other majors, because the bailout request was seen as being inevitable and has already been priced in. The size of the Portuguese bailout request has not yet been announced, but there is speculation that it will be of the order of €80 billion.

http://www.dailyforex.com/forex-fundamental-analysis/2011/04/Portugal-Asks-For-An-EU-Bailout/7633

The Bank of England had argued that inflation (whilst remaining above the target level of 3%) would moderate towards the end of the year. However, data just released by the Office for National Statistics shows that inflation, as measured by the Consumer Price Index (CPI) has declined in March to 4% from 4.4% in February. The fall has largely been attributed to a record decline in the cost of food and non-alcoholic drinks which fell by 1.4% against the same period last year.

The broader based Retail Prices Index (RPI) also declined from 5.5% in February to 5.3% in March. The RPI figure includes the cost of interest repayments on mortgages.

The data caused Sterling to fall against other major currencies since the Forex markets interpret it to mean that the MPC will have more breathing room before it needs to increase rates to combat inflation. Last week, the European Central Bank increased its interest rate by 0.25% to 1.25% over fears of inflationary pressure within the Eurozone. Sterling stands at 1.6296 to the US Dollar, a fall of half a cent, and at 1.1249 against the Euro, a decline of 0.75 Euro cents.

http://www.dailyforex.com/forex-fundamental-analysis/2011/04/UK-Inflation-Falls-Unexpectedly/7685

The Dow ended the week stronger to the tune of 1.3%, finishing the trading session at 12376.7 The Nasdaq ended the week higher by 1.7% to close at 2789.6.

The Nikkei restored a further 1.9% of its value to end the trading session at 9718.9.

Currency Markets Review

On the currency markets last week, the Euro had the best of the trading. The Dollar was stronger against Sterling, making 0.24% and closing at 1.6042 to the Pound. The Greenback lost ground against the Euro last week, shedding 0.18% to close at 1.4141. The Dollar was substantially stronger against the Japanese currency, closing at 83.8413 to the Yen, a gain of 3.3%.The Euro closed higher against the Yen ending at 118.56, making 3.5% over the course of the week. The Euro strengthened against Sterling over the course of the week by 0.42%. The close saw one £ buying 1.1344.

Commodities Market Review

On the commodities market, the price for Brent crude ended higher due to continuing volatility in the markets caused by the situation in Libya, closing at $118.7 per barrel (for May delivery); a gain of 2.7% over the course of the week’s trading. The value of gold slipped last week, closing at 1418 per ounce; representing a loss of 1.3% over last week’s value.http://www.dailyforex.com/forex-fundamental-analysis/2011/04/Forex-Week-in-Review-April-4-2011/7603

The Dow ended the week essentially unchanged, gaining 0.03%, finishing the trading session at 12380. The Nasdaq ended the week down by 0.33% to close at 2780.4.

The Nikkei regained a further 0.51% of its value to end the trading session at 9768.1.

Currency Markets Review

On the currency markets last week, the Euro again had the best of the trading; despite the Portuguese bailout. The Dollar was weaker against Sterling, losing 1.7% and closing at 1.6347 to the Pound. The Greenback lost ground against the Euro last week, shedding 1.8% to close at 1.4401. The Dollar was stronger against the Japanese currency, closing at 85.2719 to the Yen, a gain of 1.7%.The Euro closed higher against the Yen ending at 122.8, making 3.6% over the course of the week. The Euro strengthened marginally against Sterling over the course of the week by 0.06%. The close saw one £ buying 1.1351.

Commodities Market Review

On the commodities market, the price for Brent crude ended higher due to continuing volatility in the markets caused by the situation in Libya, closing at $126.7 per barrel (for May delivery); a gain of 6.7% over the course of the week’s trading. The value of gold recovered last week, closing at 1469.5 per ounce; representing a gain of 3.6% over last week’s value.http://www.dailyforex.com/forex-fundamental-analysis/2011/04/Forex-Week-in-Review-April-11-2011/7657

All of the world’s major central banks adopted a policy of reducing interest rates to stimulate growth during the worst of the global financial recession. The ECB move is the first by a major central bank to increase rates. The reason behind the move is to counter inflationary pressure – without choking off economic growth. The Eurozone consists of 17 member states all using the single currency, so it is not possible to please all members simultaneously. This point was underlined in comments made by Trichet: "The hike is unwelcome for peripheral countries, but arguably the core member states were in need of this move already some time ago. In that sense, the timing of the increase is a balancing act, which is part and parcel of the one-size-fits-all monetary policy."

Trichet's Vague Strategy

Mr Trichet would not be drawn on whether this was the first in a series of rate hikes which would take interest rates up to their more traditional levels. He remarked that the ECB viewed inflationary risk as being on the upside, but pointed out that the bank would be following an accommodative strategy. The EC recently updated its assessment of inflation to 2.2% above the ECB target value.In a parallel meeting, the Monetary Policy Committee of the Bank of England voted to leave its interest rate untouched at 0.5%.

http://www.dailyforex.com/forex-fundamental-analysis/2011/04/European-Central-Bank-Raises-Rates/7643

The Forex Trading Day

Unlike localized markets in which trading takes place in specific times zones and according to a specific national calendar Forex trading can be done around the clock, which means that you’ll have ample opportunities to trade in your spare time – whenever that is. The Forex trading day is a full twenty-four hours and the Forex week starts from 5:00 pm Sunday EST and finishes 4:00 pm EST on Friday. As such, you will have the opportunity to design a trading strategy that best complies with your lifestyle. High Liquidity and Daily Turnover

The Forex market is highly liquid which essentially means that your currency transactions will be supported because there is a large number of other trading participants. The turnover generated each Forex trading day is much larger than those produced by other markets. For example, the stock market has a daily turnover of just $25 million whereas the Forex market conducts about $3 billion in trades daily.The Importance of Transparency

As the Forex market is completely transparent, you will be able to trade on exactly the same level as big institutions, such as hedge funds and banks. Moreover, because Forex is such a gigantic market, nobody can manipulate its figures. Consequently, you can approach each Forex trading day with the confidence that you will not be subjected to any major sudden adjustments.Major Currencies

You must also realize that the major currencies that are exchanged during each Forex trading day account for about 85% of its volume. They are the US dollar, Euro, British Pound, Swiss Franc, Canadian dollar, Australian dollar, Japanese Yen and New Zealand Dollar. Nevertheless, you needn’t live in a country with one of these currencies to have a profitable Forex trading experience. Instead, you’ll just need to learn how to monitor these currencies over the course of your Forex trading day.Relationship with other Markets

Although Forex is independent of all other markets, you will find that it does have relationships with them, which can be an advantage if you’re familiar with other markets. For instance, Forex is strongly correlated to the stock market. For example, if the Dow Jones Index climbs in value, then so will the higher-yielding currencies such as the Euro and the British Pound. In contrast, the currencies exhibiting low yields will fall in value.Fees and Charges

You will not be charged any fees directly by the Forex market. However, you will accrue costs from spreads and rollover fees, etc. For example, you will either earn or be charged a fee for keeping your positions open from one Forex trading day to the next depending on the comparable interest rates of the currencies involved.Ready to try it out? Why not open a free demo account to see whether you can enjoy and profit from trading Forex.

http://www.dailyforex.com/forex-articles/2011/03/Is-Forex-Trading-for-You/7425

There are many Forex strategies that sound good on paper, but aren't quite as reliable in practice. While it is possible to make these strategies work, it's often not worth the trouble and risk of loss. Here are three Forex strategies that sound good - but aren't.

One of the most common Forex strategies that sound really good is the moving average crossover strategy. While the strategy certainly can work over time, it is rather counterintuitive when it comes to human psyche. The problem with the moving average crossover system is that they rely on a clear and defined trend. If you've been trading for a while, you know that the market only trends about 20% of the time. Because of this, you have to be able to absorb several losses before you get that one really good trade.

The idea is that one moving average will cross over the other, signaling a change in momentum. Once you take that trade, you do not exit until the moving averages cross back over each other signaling and reverse and the momentum. The problem is that if you are stuck in a sideways move the market, the averages will crisscross quite often leaving you taking one loss after another. On top of that, you have to deal with the human psychological aspect of taking so many losses before finally being rewarded. Very few traders can do this.

Another common Forex strategy that is absolutely toxic is what is known as the "Martingale strategy". While not a trading system in and of itself, the idea of this strategy is to gradually increase your position size under the idea that you will eventually be right. This has been popular lies in places like Las Vegas, and, as they say, things that happen in Vegas should stay in Vegas. The basic premise is that you risk a certain percentage, say 1% of your account on the first trade. The second trade, assuming that you lost on the first trade, will be placed with a 2% risk. This repeats until you eventually win. The biggest problem with this is that you can go on losing streaks. Before you know it, you may have lost half of your account.

Another common Forex strategy that simply isn't a smart one to use is the black box strategy. The black box strategy isn't any one particular strategy at all, rather it is an automated strategy that you pay for and the computer trades for you. While the strategies may mathematically look promising, they cannot react and adjust to so-called "Black Swan events”. What this means is that if the market is presently melting down because of some kind of political event in Asia, the black box system will simply keep trading based upon its mathematical models. One of the largest blowups in history was from a fund called Long-Term Capital Management that practice this exact type of trading. In a nutshell, a bond default in Russia sent the markets into a panic. The LTCM models were not prepared to deal with this type of event, even though they had made astronomical gains before it. The system simply traded itself the way it always did, and loss the firm massive amounts of money and was one of the biggest disasters in the financial world’s history. By the time it was all over, the Federal Reserve Bank of New York had to organize a bailout of $3.625 billion to rescue the find as it was a serious systemic risk to the financial world at large.

As you can see, there are plenty of ways to lose money in Forex trading. The trading business is difficult, and there are no shortcuts, despite what some experts may have you believe. The one thing that these poor Forex strategies all have in common is the attempt to either over-simplify trading or make it completely mechanical. If you're willing to look beyond the easy way out, you'll likely find more realiable Forex strategies that will keep you in the green.

http://www.dailyforex.com/forex-articles/2011/04/Three-Forex-Strategies-That-Sound-Good-–-But-Aren't/7626

The pair from a technical perspective looks like it is currently stuck towards a massive resistance area. The 1.42500 level slammed this currency pair into a bearish mode when last approached in late October of last year. As we test this area, technically this chart has higher lows as we go along which of course is a very bullish pattern. It appears that the downtrend is about to be tested at the 1.45500 level as a trend line from the very top of the market in 2008 connects to another high in November of 2009 coincide with where the 1.42500 level since right now.

Because of this, the answer to the direction of the pair will probably be answered in the very beginning of the second quarter. It should also be noted that there are plenty of reasons on the fundamental side that could be propelling this pair in one direction or another in March and April.

The Portuguese issue has not gone away, and it appears that a bailout is pretty much imminent. This brings up the question of whether or not some of the other struggling economies will feel the need to pay their debts. Think of it this way: If you are running a country like Spain, why would you bother paying your debt when Portugal doesn't have to? This is the kind of situation that Europeans find themselves in as the debt issues and Portugal, Italy, Ireland, Greece, and Spain are still there even if the regulators have chose to ignore them.

Meanwhile at The Fed, the United States is currently printing as many dollars as it can possibly manage. There is a running joke right now in some trading rooms that says the surest way to make a buck these days? Sell ink. As QE2 winds down in June, the question will be whether or not the Federal Reserve chooses to expand to a third act, or whether or not they will exit the easing process. If they do exit, this will be very supportive for the dollar and propel this pair to the downside.

At this point in time the forecast for QE2 almost has to be a purely technical one, as a lot of these questions are not answered at the moment. It appears that one of the best indicators as to which direction we are going is going to be a weekly close above 1.42500, or a strong weekly close below 1.40000 which would make this pair look weak. It should be noted that the peak and trough analysis does suggest that we are going upwards. However, we have major technical levels to break in the process. Keep an eye on that trend line, and you'll know which direction to go.

http://www.dailyforex.com/forex-articles/2011/03/Q2-Predictions-for-EUR-USD/7577

Indicators such as moving averages and stochastics are generally attempting to fit onto a market. They may not necessarily work in all market conditions and they do not have any intrinsic properties that a market has to abide by. However, this is not true of Fibonacci. What I think makes Fibonacci exceptional is that the Fib ratios are inherently part of natural systems, including the markets. Fibonacci ratios do not have biases for certain market conditions or economic cycles. And Fib ratios aren’t trying to fit a certain style or market; rather they are simply a natural part of market movements.

This makes Fibonacci robust, versatile and timeless.

One of my favourite Fibonacci plays is a retracement from the 88.6% level. This level is derived by taking the 61.8% Fib Golden Ratio, square rooting it, and square rooting it again.

A retracement consists of an initial move, a retracement of that first move, and then the subsequent move from the retracement, like so:

Now when I say, “This is an 88.6% Fibonacci retracement”, all that means is that the retracement is 88.6% of the size of the initial move. So if the initial move was 100 pips up, the retracement would be 88.6 pips down. It doesn’t matter if the initial move was up or down.

Now when I say, “This is an 88.6% Fibonacci retracement”, all that means is that the retracement is 88.6% of the size of the initial move. So if the initial move was 100 pips up, the retracement would be 88.6 pips down. It doesn’t matter if the initial move was up or down.Here are some examples of the 88.6% Fibonacci retracement.

Firstly, a 5-Minute GBP-USD chart where the initial move was up followed by a downward retracement:

Now a weekly USD-CHF chart, where the initial move was down followed by an upward retracement:

Now a weekly USD-CHF chart, where the initial move was down followed by an upward retracement:  This is a fantastic example of the accuracy of Fibonacci levels. After the initial move down, the price retraced back up 1,821 pips over 27 weeks, and hit the Fibonacci level within 2 pips! These kinds of setups can allow traders to have single trades that yield over 1,000 pips while still controlling their risk.

This is a fantastic example of the accuracy of Fibonacci levels. After the initial move down, the price retraced back up 1,821 pips over 27 weeks, and hit the Fibonacci level within 2 pips! These kinds of setups can allow traders to have single trades that yield over 1,000 pips while still controlling their risk.And just to showcase the versatility across markets, this is the Daily chart for the NASDAQ stock, Apple (Symbol: AAPL):

Here the stock price moved down over $27 in four days, then retraced to within a few cents of the 88.6 level, before moving down again.

Here the stock price moved down over $27 in four days, then retraced to within a few cents of the 88.6 level, before moving down again.When I trade a Fibonacci retracement, I like the price to hit the level and move away within one or two bars of the timeframe I am using, i.e. not hang around the level for several bars. In the three examples above, the price bar hit the 88.6 level once, and once only. Secondly, I like the level to be respected cleanly: the price shouldn’t penetrate the level significantly; rather it should hit the level accurately.

I always trade with a stop, and my profit target is where the retracement started, i.e. the end of the initial move up or down. Often the price will surpass that target but I am happy to take my profit at this point. I will only trade this setup with a good risk/reward ratio, usually 1:2 or greater. If I can’t find a place to keep my stop at a reasonable distance compared to my target, I will pass on the trade.

So what can we learn about Fibonacci?

1. Fibonacci principles are timeless. You won’t find yourself needing to tweak or abandon Fibonacci ideas when markets change.

2. Fibonacci principles can be used from the smallest time frames to the largest.

3. Fibonacci has no biases for certain markets: you can use them on anything that has a chart, from a stock, a currency pair, a metal or even a complex derivative.

http://www.dailyforex.com/forex-articles/2011/03/Fibonacci-The-Leading-Marker/7511

One of the best ways to identify the trend is the simple trend line on the weekly chart. The reason the weekly chart is so significant, is that it takes much more to break a trend line on that time period than the smaller time periods such as the one hour chart. By following the weekly trend line, you can see where the overall direction of the market tends to be going. If you draw a weekly trend line, you will notice that it doesn't get broken very often. In fact, it isn't that rare for these trend lines to last for years on end. As an example, take a look at what the Euro did versus the Dollar from 2002 to 2006. It was a straight shot up, and a simple trend line analysis would have told you that based upon the weekly chart.

Moving Averages

Another common way to identify the trend is to use a moving average. While the exact moving average is debatable, some of the more common ones are the 50, 100, and 200 day moving averages. By plotting these on a daily chart, you can see how over time the trend is slowly moves these moving averages in one direction or another. This shows the long-term effects on the trend due to fundamental announcements, and traders stepping in and out of the markets. It should be noted that the higher the number on the moving average, the longer it takes to move it. On the 200 day moving average as an example, it takes a massive swing and direction to change the slope of that moving average. This can help keep you in a trend for a very long time.Better yet, an excellent way to determine the trend is by a combination of the two tools mentioned above. A lot of traders will only trade in the direction of the market based upon where a specific moving averages. For example, you may pick the 100 day moving average. If price is above that 100 day moving average, you're only looking to buy. If it is below, you're only looking to sell. If you line up trend lines with the moving average, and both tell you to buy a currency pair, it becomes very clear that the trend is moving in a bullish direction. While this doesn't guarantee a 100% success rate, it certainly can keep you pointed in the right direction and allow the markets momentum to carry you forward.

By staying in the same direction of the trend, you allow the other traders in the market to push your trade forward, and help you we more profits. This is perhaps one of the most basic and fundamental ways to make money in the Forex markets. Sadly, far too many traders don't pay attention to the trend. Don't let yourself make this common mistake.

http://www.dailyforex.com/forex-articles/2011/04/Tips-on-Identifying-Forex-Trends/7634

Market Differences

Many traders regard Forex as a large melting pot for current international developments because no other institution responds to them so quickly and appropriately as this market does. In addition, Forex exhibits a number of significant differences from other markets, such as the stock market. For instance, Forex trading is not conducted at a centralized exchange that displays daily Forex rates. Instead, all its transactions are undertaken by using either the OTC (over the counter) via phone, electronic networks or the Interbank Market.Speculation Sector

You will find that there are two main sources that produce the gigantic daily Forex turnover of about $3 trillion. The speculation sector accounts for ninety-five 95% of all Forex transactions, which are conducted for pure profit only. This element, which includes investment funds, large banks, corporations and individuals, generates artificial rate exposure using the Forex daily rates in order to produce profits from the movements of price.Consequently, you may be surprised to find out that the majority of Forex trading is of a speculative nature only. In fact, the currency conversion needs of governments and businesses generate only a small percentage of the overall Forex activity.

Foreign Sector

The foreign sector is responsible for the other 5% and is produced by international businesses selling and purchasing their materials and products overseas as well as converting their currency needs. This section of traders includes companies (exporters and importers), governments and other investors who require foreign currency conversions.The business performance of these organizations can be directly influenced by the oscillating movements of their domestic currency against those of their overseas investment or businesses using the Forex daily rates.

Economic Events

Economic factors include economic conditions and policy making. For instance, a government can directly affect the interest rates displayed by its central bank by introducing new financial policies. Such measures can have serious knock-on effects on its currencies because investors tend to follow those currencies offering the highest yields. If such an announcement is made, then you can observe the effects on the applicable currency by studying the daily Forex rates.Political Influences

If political instability and upheaval occur within a country then such events can have a significant negative influence on its economy and again on its currency. As such developments increase risk aversion, you will almost certainly witness the effected currency decline in value against those of others by examining the daily Forex rates.http://www.dailyforex.com/forex-articles/2011/03/Factors-that-Influence-Daily-Forex-Rates/7397