50 cents

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Quisque sed felis. Aliquam sit amet felis. Mauris semper, velit semper laoreet dictum, quam diam dictum urna, nec placerat elit nisl in quam. Etiam augue pede, molestie eget, rhoncus at, convallis ut, eros. Aliquam pharetra. Nulla in tellus eget odio sagittis blandit. Maecenas at nisl. Nullam lorem mi, eleifend a, fringilla vel, semper at, ligula. Mauris eu wisi. Ut ante dui, aliquet nec, congue non, accumsan sit amet, lectus. Mauris et mauris. Duis sed massa id mauris pretium venenatis. Suspendisse cursus velit vel ligula. Mauris elit. Donec neque. Phasellus nec sapien quis pede facilisis suscipit. Aenean quis risus sit amet eros volutpat ullamcorper. Ut a mi. Etiam nulla. Mauris interdum. Read More →

Remedy Games

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Quisque sed felis. Aliquam sit amet felis. Mauris semper, velit semper laoreet dictum, quam diam dictum urna, nec placerat elit nisl in quam. Etiam augue pede, molestie eget, rhoncus at, convallis ut, eros. Aliquam pharetra. Nulla in tellus eget odio sagittis blandit. Maecenas at nisl. Nullam lorem mi, eleifend a, fringilla vel, semper at, ligula. Mauris eu wisi. Ut ante dui, aliquet nec, congue non, accumsan sit amet, lectus. Mauris et mauris. Duis sed massa id mauris pretium venenatis. Suspendisse cursus velit vel ligula. Mauris elit. Donec neque. Phasellus nec sapien quis pede facilisis suscipit. Aenean quis risus sit amet eros volutpat ullamcorper. Ut a mi. Etiam nulla. Mauris interdum. Read More →

This is particularly visible against the currencies where the CHF reached all time extremes, such as the US Dollar, the British Pound and the Euro. On the daily chart of the EUR-CHF, we can see the rally from 1.2409 to the current 1.3220. This happens to be a very important resistance level tested twice before.

This is particularly visible against the currencies where the CHF reached all time extremes, such as the US Dollar, the British Pound and the Euro. On the daily chart of the EUR-CHF, we can see the rally from 1.2409 to the current 1.3220. This happens to be a very important resistance level tested twice before.A breakout above this level would signal a continuation in this rally, suggesting the next objective at 1.3675 or so. Perhaps more importantly, though, it would complete the double bottom reversal pattern in the EUR-CHF, likely reversing the long-term bear market in this pair.

For that, we must see a daily close above the resistance, which has not happened yet. In addition, one should be mindful about the ECB rate decision on Thursday. Markets are clearly expecting a hike in rates, something that the central bank hinted at before. If there is no action, the Euro could suffer for a while. In the long run, though, the EUR-CHF is poised to move higher.

http://www.dailyforex.com/forex-technical-analysis/2011/04/EUR-CHF-Poised-to-Go-Higher/7624

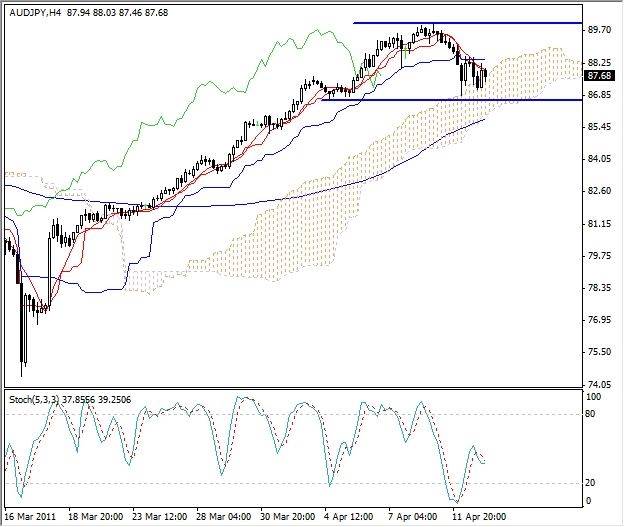

Last week the AUD-JPY reached a high for this price swing at 90.02. Since then it had drifted lower, including a relatively sharp sell off on Tuesday, which pushed it down to 86.85. That level is an intermediate term support, established by a minor low couple of weeks ago.

Last week the AUD-JPY reached a high for this price swing at 90.02. Since then it had drifted lower, including a relatively sharp sell off on Tuesday, which pushed it down to 86.85. That level is an intermediate term support, established by a minor low couple of weeks ago. What's Happening Now?

As of right now, the intermediate term chart appears to be forming a trading range, very typical after a strong trend. It is hard to say, what the outcome will be – continuation of the rally or a correction of larger magnitude. That will be decided when the AUD-JPY moves through either the support or the resistance.The support appears to be firm, with not only the previous low serving in this role, but also the Ichimoku cloud and the 100 SMA located nearby. On the upside, the recent high provides resistance at 90.02. Since this is psychologically important level (round number), the resistance might be solid, too, possibly locking the AUD-JPY into this trading range for some time.

http://www.dailyforex.com/forex-technical-analysis/2011/04/AUD-JPY-Forming-A-Trading-Range/7676

In case of the GBP-NZD the current move is even larger, about 1600 pips, as measured from the high of 2.2520 to the low of 2.0915 reached last Friday. However, the daily progress is getting smaller and smaller, indicating that the momentum maybe running out.

In case of the GBP-NZD the current move is even larger, about 1600 pips, as measured from the high of 2.2520 to the low of 2.0915 reached last Friday. However, the daily progress is getting smaller and smaller, indicating that the momentum maybe running out.When looking at the daily chart of the GBP-NZD, we can classify this sell off as a corrective move within the larger, primary bullish price swing, from 1.9858 to 2.2520. In this context, we could expect the price to reverse and resume the uptrend soon.

What's Happening Now

Currently, the GBP-NZD is at a possible important support. That is the proximity of the 62% Fibonacci retracement level, where reversals often happen. Here the price is also at the 100 SMA, another technical support/resistance tool.In addition, the Stochastic Indicator is at extremely low reading, meaning short-term oversold conditions. Altogether, the daily chart of the GBP-NZD suggests that the 2.0900-2.1000 area is vulnerable to a reversal and the price could turn around here, resuming the uptrend.

http://www.dailyforex.com/forex-technical-analysis/2011/04/GBP-NZD-Testing-Important-Support/7611

This rally in the rally has not been effected all of its crosses. The EUR-CAD, for example has hardly moved at all over the past two weeks, and settled into a consolidation. The price tested the trendline, even dipped under it, but so far remained above, preserving the uptrend.

This rally in the rally has not been effected all of its crosses. The EUR-CAD, for example has hardly moved at all over the past two weeks, and settled into a consolidation. The price tested the trendline, even dipped under it, but so far remained above, preserving the uptrend. What Can We Learn From This?

It is clear that the EUR-CAD “waits” for a catalyst to push it either way. The price is in a holding pattern, with technical indicators confirming it. We can see that the Bollinger bands have contracted sharply, which typically happens before a larger move starts. That is what we should expect here soon, but in which direction?Breaking either the nearest support or resistance will likely decide the next market move. However, since the trendline is intact, continuation of the uptrend is a little more likely. The ADX should also turn up for additional confirmation. It is possible for the EUR-CAD to start moving again as early as Tuesday, after the Bank of Canada policy meeting.

http://www.dailyforex.com/forex-technical-analysis/2011/04/EUR-CAD-Consolidation-Could-End-Soon/7664

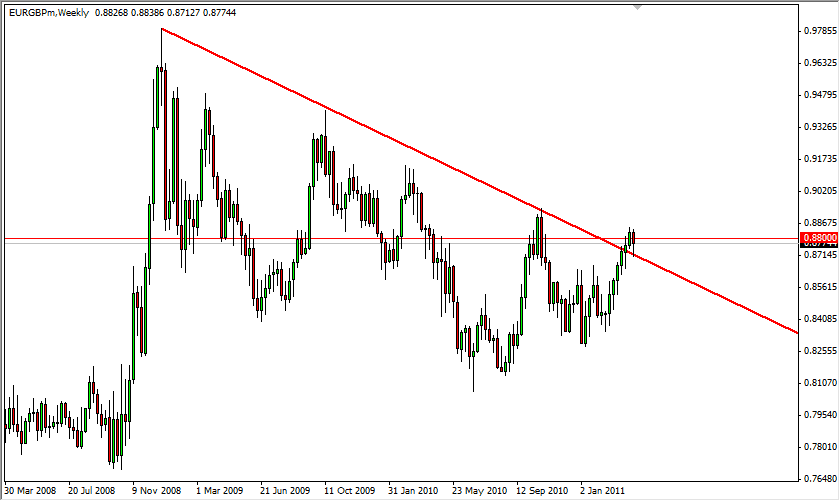

Two weeks ago, the pair had tested the 0.88 level, a key level in this pair. Although it failed, we found ourselves pushing above it the following week. This past week has had us fall again, only to bounce northward as buyers stepped in. It should be noted that there was a massive downtrend line that had gotten violated two weeks ago. This trend line was not only broken, but at the lows of this week was retested and confirmed as support.

Following Trend Lines

When looking for a breakout, the more conservative traders will wait for a pullback and a retest of the trend line to find if it will reverse courses. As the trend line was such heavy resistance since November of 2008, it should be expected to serve as fairly strong support as well. As we push higher, the 0.88 level is proving to be a pivotal level yet again as it attracts so many buyers and sellers.By looking at this trend line however, it appears that the bulls are starting to take control again, and we may have seen a capitulation of sorts by the sellers. The trend appears to be reasserting itself as this pair will certainly target the 0.90 level and then on to the 0.92 and 0.97 areas as well. Of course, if the pair breaks lower than the trend line, or the 0.87 level - we would have a false breakout of sorts.

The fundamentals also line up for this move, as the European Central Bank is getting ready to raise rates this week for the first time in a couple of years. This should be very bullish for the Euro in general, and should play out to be quite a healthy move in this pair. Of course, the real focus this week will be on the statement that the central bankers make as to whether or not more rate cuts are likely. However, it appears that the fundamentals and the charts are starting to line up which may be a sign of things moving back to some sense of normalcy. This pair shouldn't be any different.

http://www.dailyforex.com/forex-technical-analysis/2011/04/EUR-GBP-Breaking-Recent-Downtrend/7632

Currently the price is about to test that record low. On Wednesday, the USD-CHF dropped to 0.8928 in quiet trading. While it was a slow day not just for this pair, but for most other currencies as well, a slowdown so near an important level like here signals uncertainty and advises caution.

Currently the price is about to test that record low. On Wednesday, the USD-CHF dropped to 0.8928 in quiet trading. While it was a slow day not just for this pair, but for most other currencies as well, a slowdown so near an important level like here signals uncertainty and advises caution. Chances are that the price will encounter a strong support in this area. We can see the last daily candlestick forming a doji, which, following a bearish day could be a harbinger of a corrective move. Doji patterns require confirmation, so a bullish candlestick is needed now.

Other technicals also support a correction from this level. Both the RSI and the MACD indicators could have the makings of divergences. Since the price has not made new low yet, these are still only potential divergences. However, all these factors increase chances for the USD-CHF to find a support at the all time low, if only temporarily.

http://www.dailyforex.com/forex-technical-analysis/2011/04/USD-CHF-Is-Testing-the-Record-Low/7683

During the last few days, the USD-JPY made additional gains, rallying to 84.72 on Friday. In the process, it breached an important resistance of 84.50, established by a high (B). That happens to be latest minor high within the downtrend, the highest point between the last two lows (A and C). Moving through this resistance makes a strong argument for a major trend reversal.

During the last few days, the USD-JPY made additional gains, rallying to 84.72 on Friday. In the process, it breached an important resistance of 84.50, established by a high (B). That happens to be latest minor high within the downtrend, the highest point between the last two lows (A and C). Moving through this resistance makes a strong argument for a major trend reversal. For that, however, we need to see a close above 84.50, something what the daily chart of the USD-JPY failed to do so far. The recent price run up has been so fast, that it could be overbought on short-term bases, as suggested by the Stochastic Indicator. A slight pull back or a consolidation is very likely now.

Looking a little farther ahead, 1-2 weeks or so, the newly forming uptrend should continue. The ADX is rising, but at a reading of 34 is not overbought or overextended – that comes at above 50. If the price moves back above 84.50, we could see a real bull market, taking to USD-JPY to 88.00 and perhaps even 90.00 within weeks.

http://www.dailyforex.com/forex-technical-analysis/2011/04/What-Is-Next-For-USD-JPY/7600

In case of the NZD-CHF, this could be corrective move within the large bearish price swing that preceded it. This pair sold off from a high of 0.7475 in February, to the recent low of 0.6380. Since then, of course, we had the current rally to 0.7172.

In case of the NZD-CHF, this could be corrective move within the large bearish price swing that preceded it. This pair sold off from a high of 0.7475 in February, to the recent low of 0.6380. Since then, of course, we had the current rally to 0.7172. Is a Rounded Top Forming?

The price action as seen on the intermediate term chart has stalled, spending a week within a range of about 100 pips. It is also assuming a shape of a rounded top, which a reversal formation. Rounded tops, once completed, tend to have staying power, meaning that they are as reliable as chart patterns get.To complete this rounded top, the NZD-CHF must move under 0.7045, which is a pivot point here, established by a minor low on April 4. The MACD and the RSI are already drifting south, confirming a possibility of a reversal. If this rounded top is completed, the NZD-CHF could easily drop 150-200 pips.

http://www.dailyforex.com/forex-technical-analysis/2011/04/Possible-Rounded-Top-in-NZD-CHF/7647

One of them was the GBP-JPY, the ever-popular “beast”. For about a week following the intervention, it settled into a sideways pattern, before the uptrend developed. Over the last two weeks the GBP-JPY rallied about 1000 pips with very little pause. During that time, we can find only two brief slow-down periods on the intermediate term chart, both of them in the form of a flag.

One of them was the GBP-JPY, the ever-popular “beast”. For about a week following the intervention, it settled into a sideways pattern, before the uptrend developed. Over the last two weeks the GBP-JPY rallied about 1000 pips with very little pause. During that time, we can find only two brief slow-down periods on the intermediate term chart, both of them in the form of a flag. What's Going on Now?

Currently the price is forming yet another one of these patterns. Flags are continuation formations, so we could expect another move up, perhaps as high as 142.00. This particular flag is not as tight as the previous examples, but this is typical in an advanced trend. Of course, this also means that flags at this stage also have somewhat higher failure rate.If the price breaks out to the upside, we would like to see a confirmation using other tools. During this uptrend, the ADX has been working just fine in this role by showing an uptick on a move. We would like to see the same behavior here, with the ADX turning north. This would improve chances for another good size swing in the GBP-JPY.

http://www.dailyforex.com/forex-technical-analysis/2011/04/GBP-JPY-Forming-Another-Flag/7642

This particular price swing may be ending. Numerous technical factors suggest a possibility of a reversal/correction soon. When looking at the daily chart of the NZD-USD, we can see how the recent run up fits within the larger picture. Thursday’s high of 0.7645 (C), happens to be at 62% Fibonacci retracement level of the major swing down from 0.7974 (A) to 0.7108 (B). Markets often reverse at the 62% level, and that could be the case here as well.

This particular price swing may be ending. Numerous technical factors suggest a possibility of a reversal/correction soon. When looking at the daily chart of the NZD-USD, we can see how the recent run up fits within the larger picture. Thursday’s high of 0.7645 (C), happens to be at 62% Fibonacci retracement level of the major swing down from 0.7974 (A) to 0.7108 (B). Markets often reverse at the 62% level, and that could be the case here as well.Fast pace of the latest advance also pushed it just outside the upper Bollinger bands, meaning that the price is out of norm. We can see what happened in the past when this situation occurred – a correction of some magnitude in almost every instance.

In addition, the daily candlesticks are bearish. The last complete one is a doji, or a small body variation of one, indicating indecision and possible reversal. If the current candlestick is bearish at closing time, a probability for a pull back/correction in the NZD-USD would become even stronger

http://www.dailyforex.com/forex-technical-analysis/2011/04/NZD-USD-Rally-May-Have-Run-Its-Course/7595